Dealing Desk Brokers (DD)/ Market Makers: These brokers take the other side of their client’s trades, by creating the market & taking counter position for the client’s buy or sell order. They make money with the help of spreads-the difference between bid and ask price, and may also make money from your losing position. This kind of dealing might cause conflict of interest, since some brokers may make decisions based on how much profit they can yield from a trade rather than looking to help the clients with the best quote. But an ideal market maker will not give importance to how much profit their position will yield.

No Dealing Desk Brokers (NDD): Their main function is to connect the counterparties and this involves either a straight-through processing (STP) system and Electronic Communication Network (ECN). An NDD broker matches the client’s order with other traders with the help of liquidity providers. They are of two types- STP brokers and ECN brokers.

It’s really important to read through the fine print and check the reviews of the broker you are planning to open an account with. Some brokers may falsify about their process of execution.

To make it easier for you, we are created this list of 8 best ECN & STP brokers that accept traders in Kenya.

Comparison Table of Best ECN Forex Brokers in Kenya

| ECN Broker | Minimum Deposit | Lowest EUR/USD Spread | Regulation(s) | Max. Leverage | Available Instruments | Visit |

|---|---|---|---|---|---|---|

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.3 pips

|

Regulation(s): FCA, FSCA, CySEC

|

Max. Leverage:

1:500 (with Zero account) |

Available instruments: 49 currency pairs, and 100+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0 pips

|

Regulation(s): FCA, CySEC

|

Max. Leverage:

1:500 |

Available instruments: 62 currency pairs, 20+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $200

|

Lowest EUR/USD spread*: 0 pips

|

Regulation(s): CMA (Kenya), FCA, ASIC

|

Max. Leverage:

1:500 |

Available instruments: 66+ currency pairs, 100+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $200

|

Lowest EUR/USD spread*: 0.4 pips

|

Regulation(s): FCA, CySEC & FSCA

|

Max. Leverage:

1:2000 |

Available instruments: 59 currency pairs, 200+ CFDs

|

Visit Broker |

Best ECN Brokers in Kenya

Here’s our list of best ECN brokers for Kenyan traders:

- Hotforex – Best STP Broker Overall

- FXPesa – Regulated Forex Broker with zero spread account

- PepperStone – CMA regulated low spread broker

- Tickmill – 100% NDD broker

- FXTM – Good ECN broker

- IC Markets – Raw Spread ECN broker

- FP Markets – Low fees ECN broker

- Scope Markets – Local Forex Broker with ECN Type account

Now we will explore the detailed features of each broker in our list, one by one, starting from Hotforex.

#1 Hotforex – Best Overall

Regulations: FCA (UK), FSCA, FSA

Minimum Deposit: $5

Available Platforms: MT4 & MT5 platforms, WebTrader and Mobile trading

Hotforex (HF) was founded in 2010 and is considered to be very safe. It is a 100% STP broker and is regulated with FSCA in South Africa, CySEC and FCA (UK). It is registered in St Vincent and the Grenadine (SV) as an international business entity.

One of the main advantages of HF is that they are a low-cost broker. HF has the lowest spread with zero account. Their average benchmark spread for EUR/USD is 0.3 pips for zero account, and the commission is $3 per lot. HF charges you for holding your account overnight, it is called rollover charges. Another highlight is that they do not charge fees to withdraw or deposit money i.e., you will get 100% of you deposit and withdrawal amount. There is an inactivity charge of $5 per month, if your account is dormant. But there are no fees if your account balance is zero.

Hotforex offers 49 currency pairs, 7 cryptocurrencies and CFDs on 56 shares. They offer MetaTrader4 and MetaTrader5 platforms, which are the best platforms available. They support trading in Android, iPhones and iPads. If you don’t want to download the platforms, you can trade using their web platform.

The overall customer support is good. They are available 24 hours all days except for weekends. They can be connected through live chat very easily with no hold time. Clients can send in their enquiries using their email address- [email protected] and they reply within 12 hours. They can also be contacted by filling in a Contact us form. The only drawback is they do not have a local phone number in South Africa however, they can be contacted using their global number.

Hotforex STP Pros

- Well regulated, with FCA (UK), FSCA in South Africa and CySEC.

- Spread as low as 0.3 pips with Zero Account for a major pair like EUR/USD.

- No Deposit or Withdrawal fees. And accept MPesa.

- Good Customer Support.

Hotforex STP Cons

- Hotforex is not regulated by CMA in Kenya.

- The absence of a local phone number in South Africa.

- There are no local banks for deposits and withdrawals, wire transfers are possible but it takes time for the money to be credited. But they do offer other wallet deposit & withdrawal options that are faster.

#2 FXPesa – Regulated Forex Broker with zero spread account

Regulations: CMA

Minimum Deposit: $100 (for Premiere Account)

Available Platforms: MT4, MT5 platforms for all devices

FXPesa is regulated with CMA in Kenya, so they are considered safe for Kenyan traders. They offer ECN type account, called the ‘Premiere account’ with NDD execution model, which has spreads from 0 pips & commission per lot

The typical spreads for major like EUR/USD is 0 pips with their Premiere Account type. The commission per lot with this account type is $7/lot for roundturn (opening & closing a trade both).

So, typically, if you are trading 1 mini lot on EUR/USD, the total trading fees (commission plus spread), would be $0.7. This comes out to be equivalent of 0.7 pips spread for Standard/Micro accounts, which is quite low, and considered good.

They don’t charge any extra non-trading charges, and local traders can deposit & withdraw via bank in Kenya without extra fees. So, overall their trading conditions are good for ECN account traders.

#3 Tickmill – 100% NDD Forex Broker

Regulations: FCA, FSCA

Minimum Deposit: $100

Available Platforms: MT4 platform for all devices

Established in 2014, Tickmill is considered safe – since it is regulated as a securities dealer by FSA in Seychelles, is regulated by tier 1 regulators like FCA and CySEC. They are yet to be regulated by FSCA. Since Tickmill is an NDD broker, all orders are passed to third party liquidity providers and therefore, no chance for a conflict of interest.

Their average spread with their ECN Type pro account is from 0.0 pip to 0.2 pips with a $4 commission per trade. They do not charge an inactivity fee but they do charge a rollover charge according to the currency pair you are trading. They do not charge withdrawal and deposit fee; therefore, you will get the 100% amount.

Tickmill offers 62 currency pairs, CFDs on 16 indices, 2 on metals and 4 bonds. They don’t offer cryptocurrencies and only have very limited CFDs. The average marker execution speed for Pro accounts is .15 seconds.

Tickmill provides MT4 trading platform in phones and also provides web version of the platform. Withdrawals and Deposits can be made either using credit or debit cards, Bank Transfer or E-wallets.

Tickmill’s overall customer support is not good. The live chat option is slow with a hold of a few minutes. They are available 24/5 (except for weekdays). They provide email support; the enquiries can be sent to- [email protected]

Just like HotForex, Tickmill too, doesn’t have a local phone number in South Africa. You can contact them using their global number.

Tickmill Pros

- They let the clients in Kenya to open trading account with a minimum deposit of $100

- Since they are an NDD broker, chances for a conflict of interest are absent.

- Very low spread with the pro account.

- Zero charges on Withdrawals and Deposits.

Tickmill Cons

- They are not regulated with CMA.

- No local phone number in Kenya.

- MetaTrader 5 is not offered as a platform.

#4 PepperStone – CMA regulated low spread broker

Regulations: Capital Markets Authority (CMA) of Kenya, ASIC

Minimum Deposit: $200

Available Platforms: Metatrader 4, MT5 for desktop, Web & mobile

Established in 2010, they are STP brokers, grown to become one of the best forex brokers in the world. They are considered safe, since they are regulated with CMA, under Capital Market acts and regulations, 2017. They are also regulated with ASIC in Australia and FCA (UK). They are yet to be regulated with FSCA. They are audited by Ernst and Young, which means, they must avoid conflict of interests and should follow strict guidelines.

Their average spread with the Razor account is from 0.0 pip to 0.3 pips with a commission of $7. There are no withdrawals or deposits fee, but there are standard rollover charges. The minimum deposit required by the razor account is $200, the withdrawal and deposits can be done with the help of debit/credit cards, wire-transfers or e-wallets.

There are 66+ currency pairs available for trading, 100+ CFDs on cryptocurrencies, shares, metals and commodities available. Pepperstone offers trading platforms like MT$, MT% and cTrader. cTrader is a highly efficient platform which is a favourite among expert CFD traders.

Their customer service is award-winning, which has personalized customer support with real trading experts, 24-hour support on all days. The live chat facility is fast and helpful and they also offer email support. Local phone number is also available.

PepperStone Kenya Pros

- Low spreads and commissions.

- Three trading platforms- MT4, MT5, cTrader.

- Award-winning customer support.

- Easy withdrawal and deposits; low minimum deposit.

- Regulated with CMA & multiple Tier 1 regulators

PepperStone Kenya Cons

- Limited CFDs.

- Limited in risk management tools.

How we selected the Best ECN Brokers?

We are ranking the brokers on the basis of 4 Factors:

1. Broker’s Regulations: Always make sure the broker you choose is regulated with a tier 1 regulator like FCA (UK), FSCA, ASIC, CySEC etc. or with CMA, which regulates capital markets and non-dealing derivative brokers in Kenya.

2. Trading Fees: The spread is not the only income for the brokers. They will add a small commission for every trade you make. These charges should also be taken into consideration while calculating your total trading costs.

You should not simply check the low spreads & think that the broker has low fees. The ECN broker can make money from you by charging higher commission, Swap fees, and other non-trading charges.

Check the exact spread the broker is offering with that account type, and the exact commission that you will have to pay.

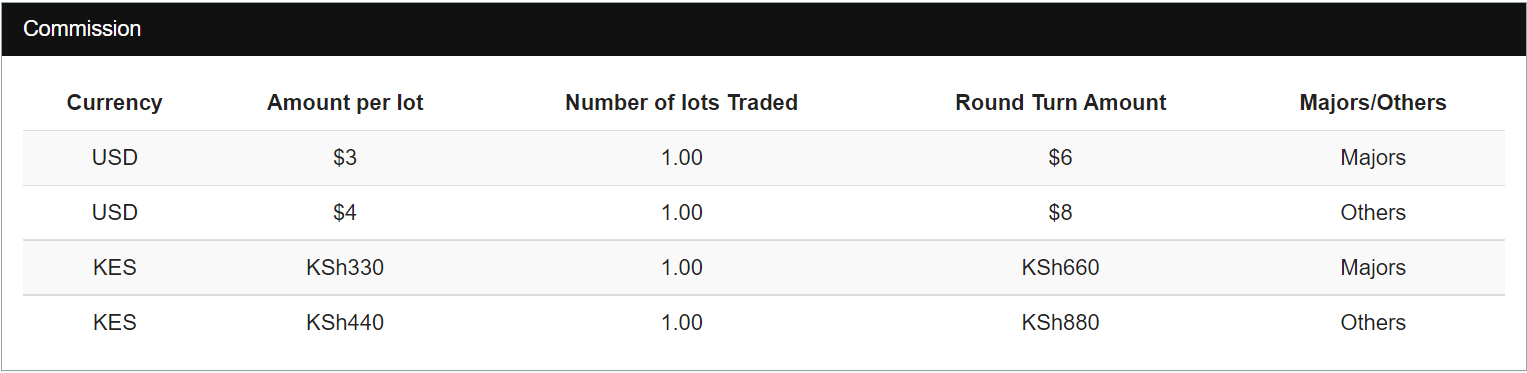

For example, if you want to trade EUR/USD, and you choose HotForex’s Zero Account (their ECN type account). then the typical spread is 0.1 pips. The commission per lot for majors is $6 or Kes. 660, depending on your account’s base currency. The below screenshot is the example of the commission at HotForex with their Zero account.

The total fees that you will be charged for an intraday trade for EUR/USD for 1 Standard lot in this example above will be $1 (typical spread of 0.1 pip) + $6 (commission for majors). This is equal to $7 for the trade of 1 standard lot.

Of course, if the spread is higher then the overall costs would be higher. But generally, the typical trading costs are lower with the ECN type account. But you must ensure that the broker who you are trading with is regulated, othewise your funds will not be protected.

3. Trading Platform and Conditions: The platforms used by the participants to trade are called trading platforms. They may use popular platforms like, Metatrader4 (MT4) or mobile apps. MT4 is convenient for beginners and if you are planning to use a broker with their own platforms, make sure to do a demo to understand how it works.

The platforms used by the brokers should enable you to execute the order smoothly. Always check the reviews to make sure no bad order execution has been reported before.

We show the platforms used by the brokers in our list. Always choose a broker who lets you withdraw your funds instantly and make other deposits.

4. Customer Support: Also, check how helpful your broker’s customer support is. Make sure they provide round-the-clock support on all week days.

Frequently asked questions: ECN Brokers

What are ECN/STP brokers?

STP brokers: They run their client’s order through several liquidity providers who have interbank market access. They rank the bid/ask quotes provided by the liquidity providers according to the prices and adds a small mark-up to earn. Therefore, each broker has different spreads.

ECN brokers: They use electronic platforms to let the participants trade with each other. They earn through small commissions.

What are the best ECN Brokers in Kenya?

Which ECN type brokers are regulated in Kenya?

Why choose STP brokers over market makers?

Market makers are also called desk dealing brokers (DD). Market makers go against their clients i.e. to the opposite side of the trade to create a market for the client.

This may cause a conflict of interest since the broker may position themselves to acquire higher profits. This will not be good for the client. Not all DD brokers will do this, but there is a good possibility for this to happen.

Therefore, it is always clever to choose an NDD broker, preferably an STP broker to avoid this conflict of interest and to make sure your brokers main aim is to create profits for you and not them.