FXTM Review 2023

FXTM is a globally well regulated forex broker. But is it any good for traders in Kenya?

ForexTime or FXTM is a global CFD and Forex broker which has been offering online trading since 2011. The parent company of the broker i.e. Exinity Limited is regulated by the CMA in Kenya, Financial Conduct Authority (FCA) in the UK, CySEC, and FSCA (South Africa).

Since FXTM is regulated with multiple top tier regulators, we consider them to be safe.

FXTM trading platforms are MetaTrader based, and they offer MetaTrader 4 and MetaTrader 5. They offer seven types of accounts, and provide 57 currency pairs, CFDs on 173 single stock shares, 11 Indices, six metals, three energy contracts, and three cryptocurrencies.

Their customer support is good and very efficient. But they charge high fees for stock CFDs, they also charge inactivity fees and for most of the methods, a withdrawal fee too. Their Advantage account is ECN type account with Low fees, but with their Micro account, the typical spreads are quite high.

We will be providing you a detailed and transparent review about FXTM and sharing what we think about them.

FXTM Pros

- FXTM’s parent company Exinity Group is regulated by CMA. Plus FXTM is well regulated with 3 Top Tier regulators i.e. FCA, FSCA, CySEC.

- Good Customer Support & live chat is available.

- Negative Balance Protection is available.

- Quick & Easy Account Opening process.

- Offer Copy Trading Platform.

- Offers MT4 & MT5 trading platforms for mobile, desktop & web.

FXTM Cons

- High trading fees: The trading & non-trading charges with Standard accounts are much higher than other brokers.

- There is no local phone number for support in Kenya.

- Charges Withdrawal fees.

FXTM Kenya – A quick look

| 👌 Our verdict | #5 Forex Broker in Kenya |

| 🏦 Broker Name | Exinity Capital East Africa Limited |

| 💵 Lowest EURUSD Spread | 1.9 pips (with Micro Account) |

| 📅 Year Founded | 2011 |

| 🌐 Website | www.forextime.com |

| 💰 Minimum Deposit | $10 |

| ⚙️ Maximum Leverage | 1:1000 |

| ⚖️ Regulation(s) | CMA, FCA, CySEC, FSCA |

| 🛍️ Trading Instruments | Forex Trading, CFD Trading on Shares, Commodities, Indices |

| 📱 Trading Platforms | Webtraders, Android & iOS Apps, MT4 | 📒 Demo Account | Yes |

| 💰 KES Base Currency | No |

Is FXTM Kenya Legit?

FXTM is regulated in Kenya with CMA & by 2 other top tier regular FCA & FSCA, and many other financial regulators. So, they are considered safe.

FXTM is regulated and authorized under following regulators:

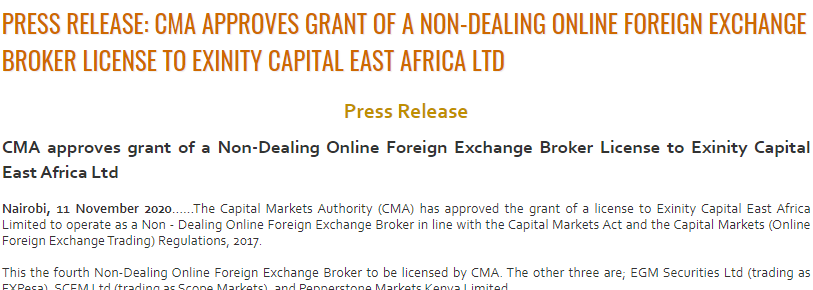

- Capital Markets Authority of Kenya(CMA): FXTM’s parent company Exinity Group is one of the 4 CMA licensed forex broker for online FX trading in Kenya. Exinity Capital East Africa Limited was granted the license for Non-Dealing Online Forex Broker in November 2020.

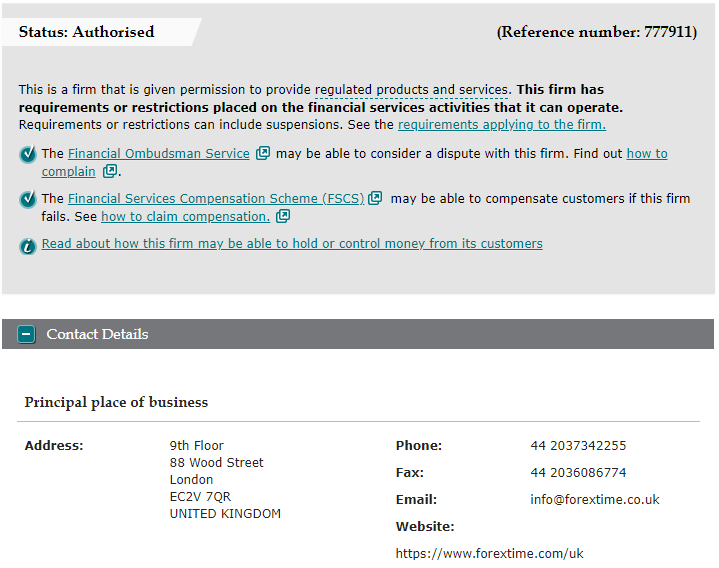

- Financial Conduct Authority (FCA): FXTM is registered with the FCA of the UK under name ‘ForexTime UK Limited’ – which is authorized and regulated by FCA with license No. 777911.

- Financial Sector Conduct Authority (FSCA): ForexTime Limited is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa with FSP No. 46614.

- Cyprus Securities and Exchange Commission(CySEC): They are also regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12.

Are they safe? Yes, would be our short answer as FXTM is regulated by multiple top-tier regulations.

Another fact worth mentioning is, Exinity Limited (the parent legal entity of FXTM) is a member of Financial Commission, an international organisation engaged in resolving disputes within the financial services industry in the forex market.

FXTM provides Negative balance protection for trading forex and CFDs with all their trading accounts for customers in Kenya.

FXTM is considered to be a fairly safe broker, since they are well regulated with multiple top tier regulators

FXTM Fees

Trading fees at FXTM are high for forex & average for other CFDs. Their overall fees are higher than most of the brokers in the industry. The spread is very higher for their “Cent Account” and the CFD trading fees are high.

We went ahead and compared FXTM with some other popular brokers in Kenya for you. This should make it easier for you to understand the difference. We compared FXTM with Hotforex and XM for the spread they have.

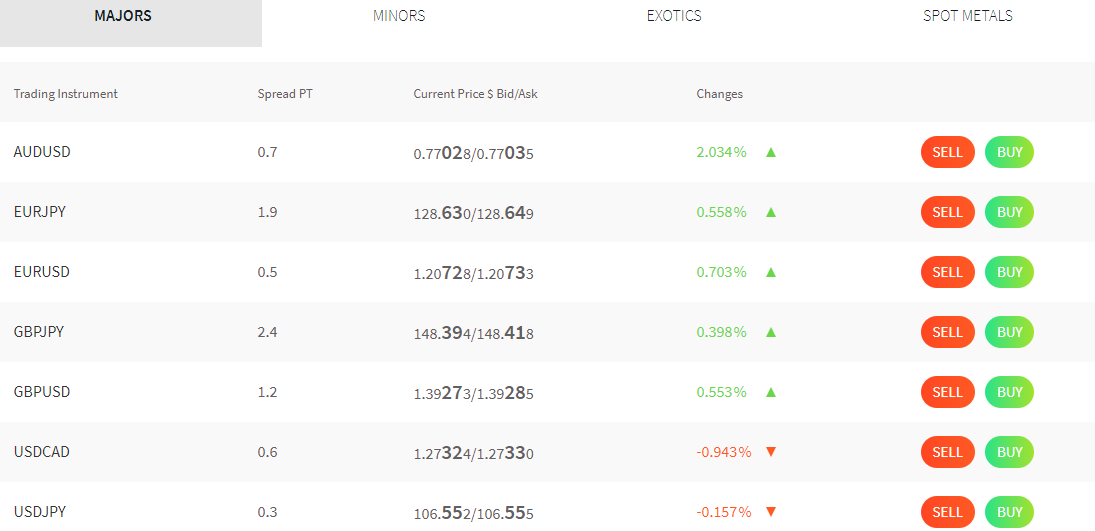

Here is a breakdown of fees at FXTM:

1. Spread: FXTM has the minimum variable spread of 1.9 pips for standard account and fixed spread for Cent account. The typical spread for standard and cent accounts are 2 pips and 2.4 pips respectively.

But, the spreads for ECN account is lower, with the minimum spread of 0.1 pip and typical spread of 0.4 pips. And, spread for EUR/USD per lot is 0.1 pips, which is average forex fee.

Whereas, Hotforex has a lowest spread of 1 pip per lot for EURUSD with their Micro and Premium account and a spread as low as 0 for their zero account. And, XM has the average spread as average spread for EUR/USD of 0.8 pips with their Ultra Low account.

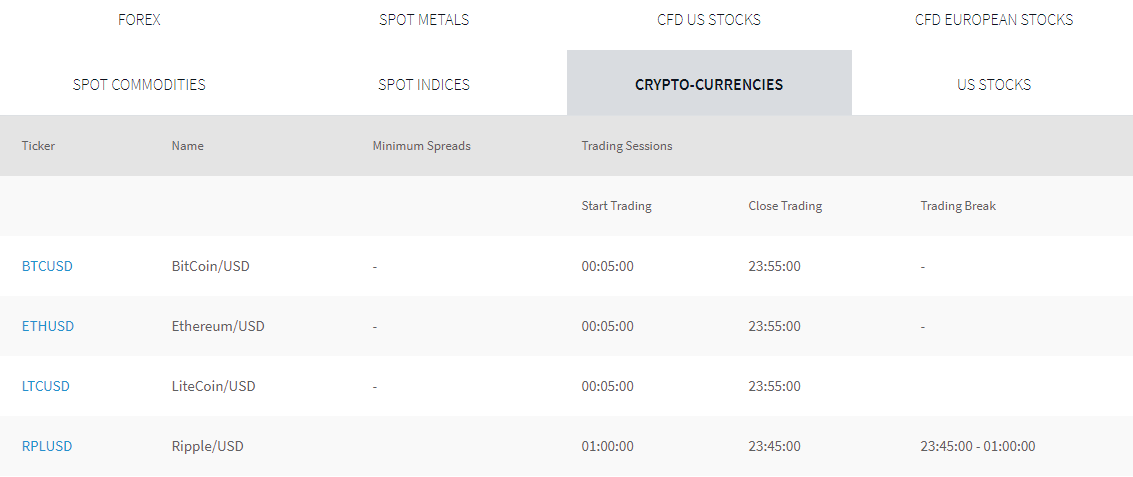

Below table from FXTM’s website highlights their average/typical Crypto CFD trading spread with all their account types.

2. Commission(s): Even though the spreads are higher, they don’t charge commission with Standard accounts. Whereas they do charge commission for ECN accounts, but it is only charged for opening & closing a position, and can be lower if you maintain a higher account balance. Usually $2 is charged per side, i.e. $4 total.

3. Deposit and Withdrawal Fee: All deposits are free of charge for traders in Kenya.

But they charge you with a withdrawal fee with most of the available withdrawal methods, according to the method you use to withdraw the money, and the currency you withdraw.

For example; They charge $3 for credit card withdrawal, though there is no difference according to the place of residence.

5. Inactivity Charges: If your account has been inactive for 6 months, they will start to charge an inactivity fee of $5 per month.

Compared to other brokers, FXTM has higher trading fees & some hidden non-trading charges.

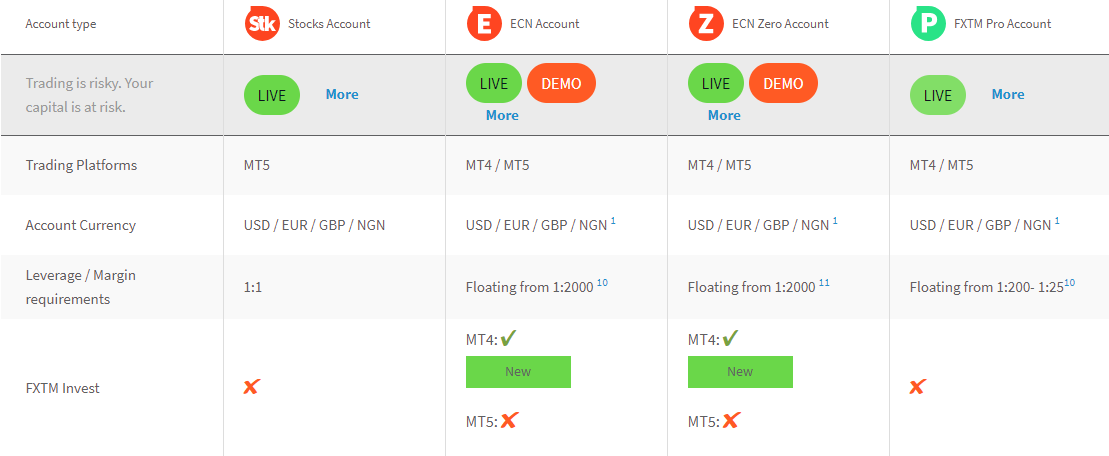

Account Types at FXTM

Opening an account with FXTM is easy & quick for traders in Kenya. They offer multiple account types to choose from, and on submitting your KYC documents, the account is normally opened within under 48 business days.

FXTM Demo Account

FXTM offers free demo account to traders in Kenya.

FXTM Live Accounts

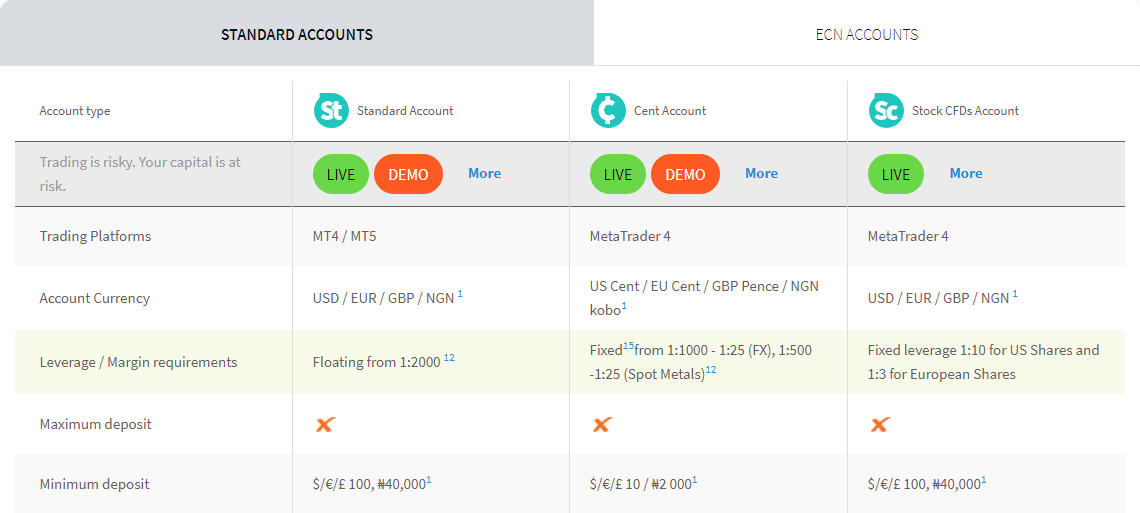

There are 3 types of Standard accounts- Standard, Cent, and Shares account types. So, how exactly are they different?

- The Cent account is their basic account type with floating spread. It allow you trade with cent (1000) lots. This account is perfect if you are a beginner trader. The minimum deposit required is $10. Minimum spread is 1.9 pips and the typical spread is 2.4 pips. The max. leverage with this account is 1:1000.

- The Standard account, too has a floating/variable spread, leverage of up to 1:1000 which is adjustable, and hedging is allowed. The minimum deposit required for this account is $100. Minimum spread is 1.6 pips and the typical spread is 2 pips.

- The Stock CFDs account is for traders looking to trade global stocks as CFDs. No commission is charged for this account, and you can trade on 160+ US & European stocks with this account. The maximum leverage for this account is 1:10 for US stocks & 1:3 for European stocks. The minimum deposit required is $100

FXTM ECN Accounts

FXTM offers 3 ECN Accounts. Let’s see their differences:

- The ECN Zero account: This is commission free ECN account, instead of market maker model with Standard accounts. The minimum deposit required is $200 and the minimum spread is 0.1 pips and the typical spread is 2 pips.

- The ECN account: is a true ECN type account. There is a $4 commission per lot, and the spread starts from 0.1 pips. Traders are allowed to do hedging and scalping. The minimum deposit required is $500. The minimum spread is 0.1 pips and the typical spread is 0.6 pips.

- FXTM Pro: The account has a spread which starts from 0 pips and no commission is charged. The minimum deposit required is $25,000. And the minimum spread is 0.1 pips and the typical spread is 0.4 pips.

How to open account with FXTM

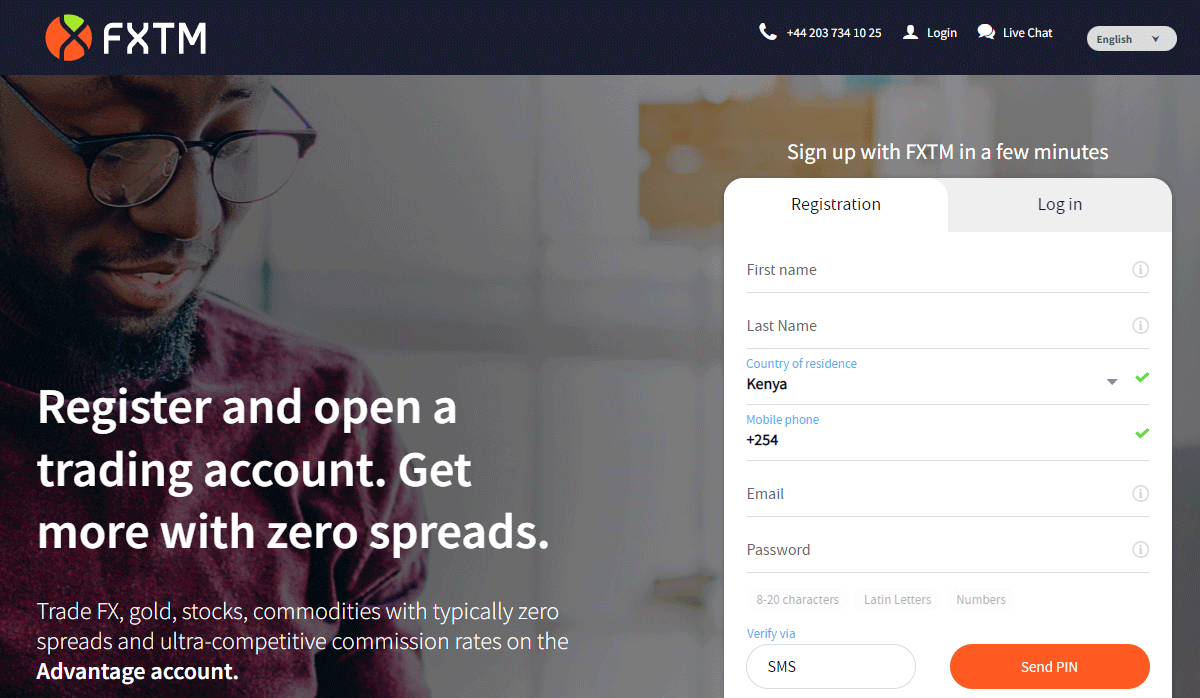

Opening a trading account with FXTM is very simple and take just 2 minutes only. You can follow the below steps to open a live trading account with FXTM:

Step 1) Click On OPEN ACCOUNT button: First of all you need to open the home page of FXTM website. After clicking on OPEN ACCOUNT button at top of the menu bar, you need to enter the details as shown in the below screenshot.

Step 2) Complete your profile: Now you need to enter your basic details like gender, country, address for completing your profile.

Step 3) Choose Account Types: Select the trading account types and set the trading account password.

Step 4) Profile Verification: At this point you need to verify your account details by uploading the ID proof and Adress proof. This verification can take few hours depending upon the type of your uploaded documents.

Step 5) Make a deposit: At last you need to make a deposit for adding funds to your trading account for start trading. You can choose any of the payment method.

That’s all! you can now save the login details set by you while signup.

Trading Instruments at FXTM

FXTM offers multiple trading instruments & their offering is fair.

The following instruments are available for trading at FXTM:

- Forex Trading – 59 currency pairs

- Cryptocurrencies – 4 including Bitcoin, Ethereum, Litecoin & Ripple

- 11 CFD Indices

- Commodity CFD Trading – 3 commodities

- Spot metals- Gold and Silver

- Stock CFDs- 160+ US & European stocks.

FXTM Web & Mobile Trading Platforms

FXTM is a Metatrader based broker. Their platforms are available for all devices.

Metatrader: FXTM offers Metatrader platforms (both MT4 & MT5) for desktop, web & mobile. Metatrader is very easy to use for beginner & experienced traders, has clear reporting and is very customizable.

Mobile Trading Platform: Their mobile platform is available for both iOS and android, also both MT5 and MT4 are available.

We tested their MT$ platform. It offers a great look, feel and is extremely user friendly. Here too, FXTM only offers one step login and no biometric login. Search function is pretty good and very easy to use. Placing orders is the same as the web platform. You can get alerts and notifications but these can only be set on a desktop platform.

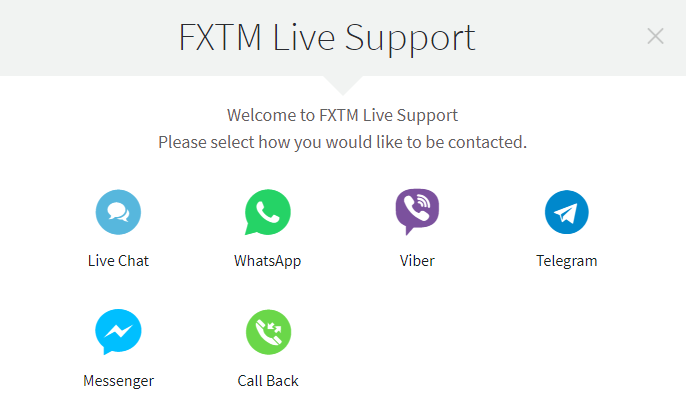

FXTM Customer Support

FXTM has quick & friendly customer support. There are multiple ways to contact their support – including chat, email & international phone number.

But their support staff are available only on weekdays, and there is no local phone number for Kenya.

FXTM can be contacted through:

1. Quick Live Chat: They have good live chat. We contacted them 3 times with our questions, the chat was connected in under 1 minutes & the staff responded quickly & accurately for our questions. We felt their chat is better than most other brokers.

They are also available through WhatsApp, Viber, Telegram and Facebook Messenger.

2. Fair Email Support: We sent them a query through email and got a good response within 2 hours. That was not bad but there are brokers with better email support.

3. No Local Phone: They don’t have a local phone number in Kenya. But you can request a callback with the account manager via their chat.

Apart from this, they have very good guides for beginner traders, which are better than most brokers. Overall, we find their support to be fair.

Do we Recommend FXTM?

Yes, we do recommend FXTM Kenya as they are a well regulated forex broker.

FXTM is a safe broker, regulated by multiple top tier regulators including Financial Conduct Authority (FCA) & FSCA. They are well established in the industry too.

Looking at the pros, they have an good customer support which is helpful & quick, have a free demo account and good education section on their website. And they have platform on multiple devices.

Also, if you choose their Advantage account, then the overall trading fees is quite low. For example, as we have explained above in the fees section, their typical spread for EUR/USD is as low as 0 pips with this account, and the commission is around $4.88/lot. This is quite low in comparison to other CFD brokers.

But, their trading fees with Standard & Cent accounts is much higher than other brokers. So, if you choose this beginner account, then your fees would be quite high. And there are non-trading charges including inactivity fees and withdrawal fees. And the support is not available 24/7.

Overall, if you don’t have problem with higher trading fees with Cent account then FXTM is worth signing up with. But if you need low fees, then you should choose the Advantage account.

FXTM Kenya FAQs

What is FXTM minimum deposit for traders in Kenya?

Is FXTM a legit forex broker?

What withdrawal methods are available at FXTM Kenya?

FXTM (ForexTime) Kenya