IC Markets Review 2023

How does IC Markets compare to other brokers in Kenya? Let's find out.

IC Market is a reputed forex & CFD broker that also accepts traders from Kenya. IC Markets is considered a safe broker as they are regulated with 2 major regulatory bodies: the Australian Securities and Investments Commission (ASIC) of Australia (AFSL No. 335692), The Cyprus Securities and Exchange Commission (CYSEC) of Cyprus (362/18).

IC Markets has a low fee for Forex trading and has a number of other trading options to trade from. The trading instruments available, apart from Forex, are CFDs on Commodities, Indices, Bonds, Cryptocurrencies, Stocks, and Futures.

They have a very good support team which is available 24/7. There is a live chat option available which is quite prompt & accurate. Any query asked is answered within seconds. Kenyan traders can also reach out to them via emails, which is quick too.

Taking into consideration the regulation, the fee charged trading instruments, and the support provided by IC Markets they are a safe & good broker for FX Traders in Kenya.

Let’s see more insight on the different aspects of the broker including fees, trading accounts, platforms of trading provided and why do we recommend IC Markets.

IC Markets Kenya – A quick look

| 👌 Our verdict | #8 Forex Broker in Kenya |

| 🏦 Broker Name | IC Markets Kenya |

| 💵 Lowest EURUSD Spread | 0.62 pips (with Standard Account) |

| 📅 Year Founded | 2007 |

| 🌐 Website | www.icmarkets.com |

| 💰 Minimum Deposit | $200 |

| ⚙️ Maximum Leverage | 400:1 |

| ⚖️ Regulation(s) | ASIC, CySEC, Financial Services Authority of Seychelles (FSA) |

| 🛍️ Trading Instruments | Forex Trading, 100+ CFDs on Shares, Commodities, Indices, Cryptos |

| 📱 Trading Platforms | MT4, MT5 for PC, Mac, Web, Android. And cTrader platform. |

| 📒 Demo Account | Yes |

| 💰 KES Base Currency | No |

Is IC Markets Safe?

Safety of funds & trading transparency is the most important part of choosing a broker.

IC Markets is considered safe for Kenyan traders as they are a reputed forex & CFD broker, and are regulated by multiple regulators.

IC Markets is regulated with following regulators:

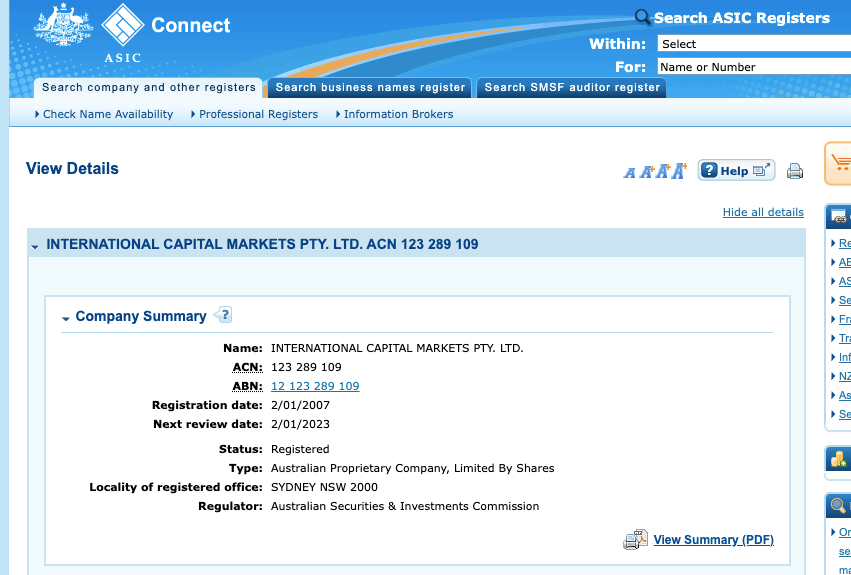

- Australian Securities & Investments Commission (ASIC): IC Markers is regulated as International Capital Markets Pty Ltd with Tier 1 regulator ASIC license number 335692 ACN 123 289 109).

- Cyprus Securities and Exchange Commission (CySEC): IC Markets (EU) Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under the CIF Licence No 362/18

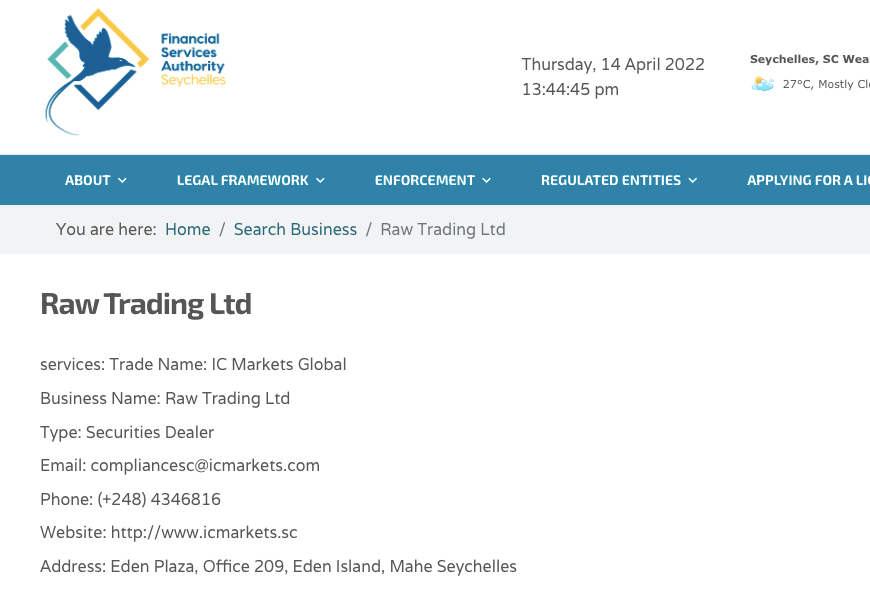

- Financial Services Authority (FSA), Seychelles: We consider this an offshore regulator, Traders from Kenya at IC Markets are registered under Financial Services Authority (FSA) of Seychelles under dealer Licence number: SD018.

Considering IC Market’s long industry reputation as a low-cost regulated forex broker, we consider them to be safe & relatively low risk. Overall, IC Markets broker is well regulated and is considered safe for trading.

Safety of Funds:

IC Markets also have segregation of clients’ funds. Clients’ money is held in a separate fund and is not used for any operational expenses or purposes.

The funds of clients at IC Markets are held in segregated client accounts with a Top Tier Australian Bank. Thus, this would give additional assurance to the investors regarding the safety of their money deposited with IC Markets.

IC Markets Fees

IC Market’s trading fees depend on the instrument you are trading & our trading account type.

For trading in Forex following metrics were compared by us:

1. Spread: We take EUR/USD for comparison, the average spread with Standard Account is 0.62 pips. The average spread for Raw Spread Account is 0.02 pips.

This is relatively low compared to the fees of other platforms like FXPesa & Hotforex.

2. Commissions with Raw Spread Account: The Standard Account comes with no commission.

The Raw Spread Account has a commission of $3.5 per lot per side which is $7 per lot of buy and sell. Therefore, the customer has a choice of choosing the account. If customers are comfortable paying a commission, they can opt for the Raw Spread.

3. Zero Deposit/Withdrawal fees: There is no deposit or withdrawal fee charged by IC Markets. This is a positive point from the customer’s point of view.

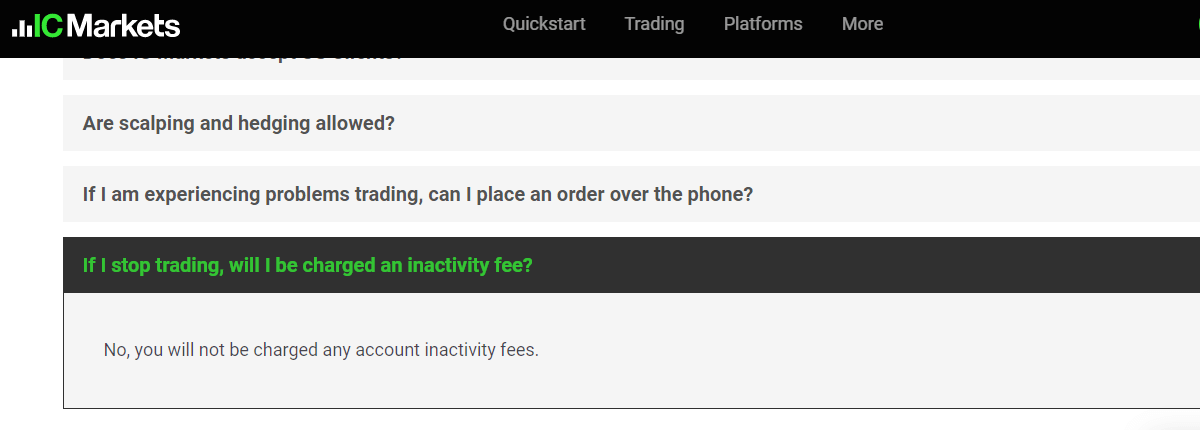

4. Inactivity fees: There is no inactivity fee charged by IC Markets. The customer can trade without any time constraint, without worrying about dormant account fees.

Overall, IC Markets have a very competitive spread with their Standard account. The commission with the Raw spread account is a bit higher compared to ECN brokers that offer raw spreads, but the spread is very low with this account.

Account Types at IC Markets

IC Markets have two major Live account types. The first one being ‘Raw Spread account’ and the second one being ‘Standard Account’.

Both the accounts have almost all the features with slight differences.

The Standard Account has no commission whereas the Raw Spread charges a commission. In Standard Account, the spreads start from one whereas in Raw Spread Account is basically a zero-spread account.

The Standard Account is suitable for beginner traders that want a very simple pricing structure with all the important trading features. On the other hand, Raw Spread Account is best suited for expert traders like automated trading through Expert Advisors and Scalping.

On the negative side, IC Markets does not offer Negative balance protection with any of their trading accounts.

Following table will give you a more detailed view of the differences between the two account types.

How to Open Trading Account with IC Markets

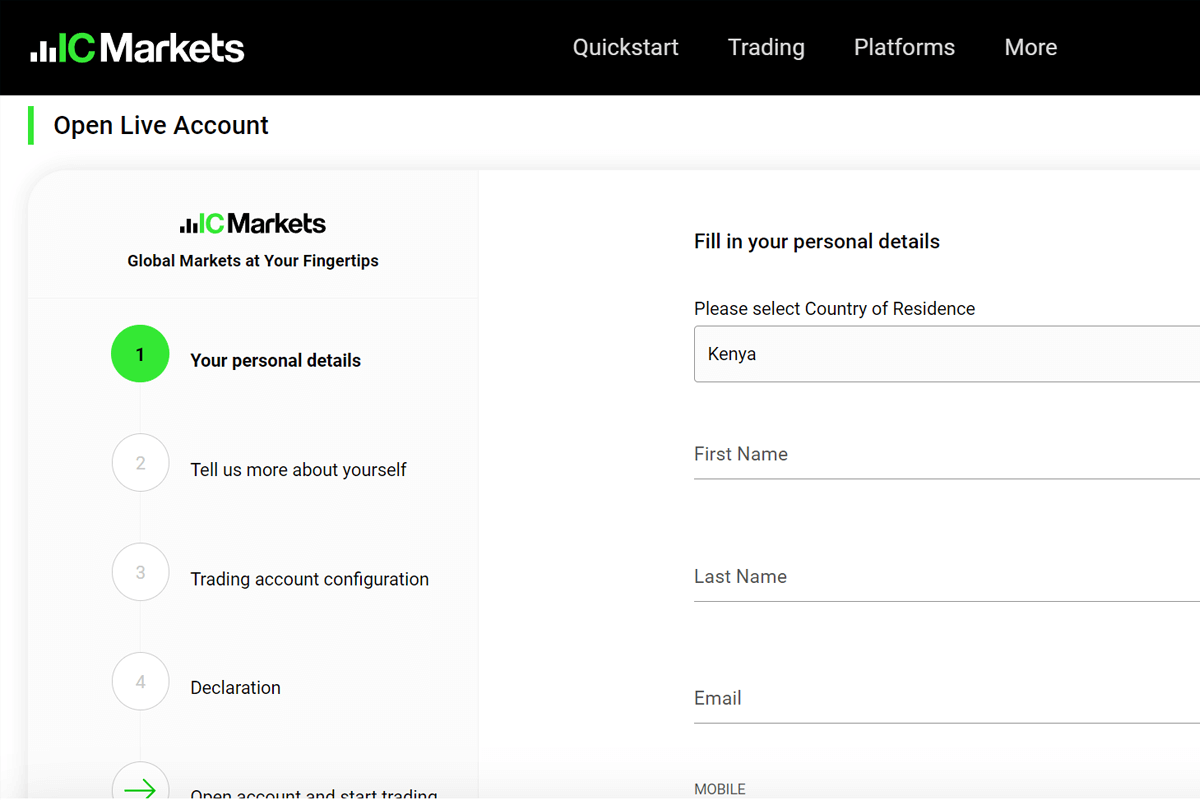

For opening account with IC Markets, traders need to follow the following steps:

Step 1) Open the home page of IC Markets and click on Start Trading at the top of the page.

Step 2) Now enter your basic details and click on Next button after entering the details.

Step 3) At this stage, you need to select your preferred trading platform and account type.

Step 4) In client area, upload the ID proof and address proof for account verification.

Step 5) Once your account is verified, you can funds you account for start trading.

Trading Instruments at IC Markets

IC Markets has a wider range of trading forex & CFD trading instruments compared to other popular brokers in Kenya.

| Instrument | Number |

|---|---|

| Forex | 61 currency pairs |

| Commodities | Over 20 commodities |

| Indices | 25 Indices |

| Bonds | Over 9 Bonds |

| Stocks | 1800+ stocks |

| Cryptocurrencies | 21 of the most popular Cryptos |

| Futures | 4 Global Futures available to trade |

Web & Mobile Trading Platforms

IC Markets has the 2 most popular third-party trading platforms.

One is Metatrader (MT4 & MT5) by MetaQuotes Softwares and cTrader platform suite developed by Spotware systems.

MT4 & MT5 are the most popular charting platforms for traders worldwide. The broker has good trading conditions and fast execution speed in MT4. Raw Spread Account and Standard Account both have availability to choose MT4, MT5 or cTrader platforms.

Overall, IC Markets is a Metatrader supporting broker. So you will get access to the desktop platform, web-based interface & mobile apps for Android, iOS.

Their platform is easy to use & quick. We did not experience any hold time or freezing on their apps or desktop platform.

IC Markets Support

Support at IC Markets is quick, knowledgeable & readily accessible.

You can get support via following methods:

1. Fair Live Chat: Live chat is very responsive towards any query forwarded to them as per our tests. There was never a hold time of longer than 15 seconds when we tested.

Our queries regarding their platform, fees, withdrawals were answered accurately & quickly without escalations.

2. Good Email support: Email is also a good way to contact them. Their email is quick in answering when we required support for backend tasks. The response time to emails is within 2 hours on a weekday, which we consider to be fair.

3. Phone support: No Kenyan phone support or trading desk is available, which is a con. This can be one problem for the Kenyan traders to reach out to IC Markets via phone. But they have international phone numbers which you can call or request a callback in some cases.

Overall, IC Market’s support is pretty decent compared to other brokers. We would rate their support to be very good otherwise if not for the absence of a local phone number.

Do we Recommend IC Markets?

We do recommend IC Markets, as they are a very reputed broker with low & transparent fees.

The trading account can be opened very easily. There is no withdrawal or deposit fee charged. Compared to other brokers in the market, IC Markets have one of the lowest spreads, have good research functions, and provide price alerts too. They have decent educational content on their website.

They support popular Metatrader & cTrader platforms, which is really a big positive for us. They have good customer service. They provide very quick support via mail and live chat.

One thing we dislike, is that IC Markets does not offer Negative balance protection.

But all in all, if we had to choose then IC Markets is a very good option for Kenyan traders to choose from among other brokers.

Frequently asked questions

What is the minimum deposit at IC Markets?

The minimum deposit at IC Markets Kenya is $200. IC Markets offers 3 account types, and the minimum deposit is the same for all accounts.

Does IC markets accept Kenyan clients?

Yes, IC Markets accepts traders from Kenyan. You can open account by submitting your 2 KYC documents i.e. your ID proof & Address proof.

Does IC Markets offer MT4 platform?

IC Markets offers MT4 & MT5 trading platforms, available on all devices. Once you open an account with IC Markets, you will receive Metatrader signin details on your registered email.

Is IC Markets a trusted forex broker for Kenyan traders?

IC Markets is regulated by 1 Top Tier regulations ASIC, and 1 Tier-2 regulator CySEC. So, we consider IC Markets a safe broker for Forex & CFD trading in Kenya.

IC Markets Kenya